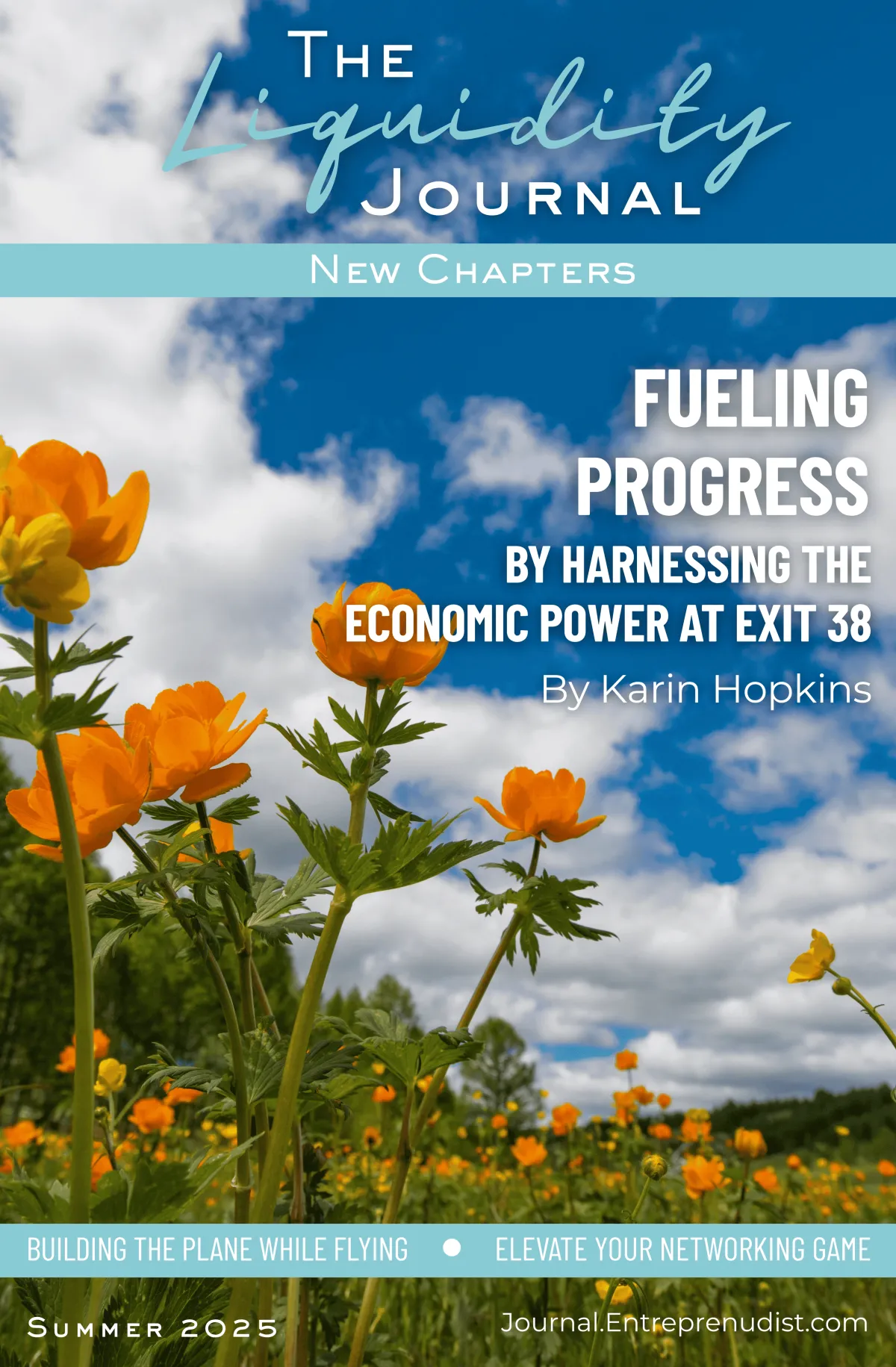

The Next Liquidity Event Is In

In This Issue Of The Liquidity Journal

The Liquidity Journal

A dynamic publication tailored for business owners, aspiring entrepreneurs, corporate executes, affluent retirees, and investors.

Our core focus is on delivering actionable insights into leadership, strategy, systems, and motivation. Designed otherwise inform and inspire, the journal serves as a resource for those looking to grow, lead, and innovate in today’s competitive business landscape.

Ciera Peters

Editor In Chief

Ciera Peters is Editor In Chief of The Liquidity Journal and COO of ShieldWolf Strongholds. After years in the corporate world, she made the leap into entrepreneurship, driven by a desire to create space for bold ideas and practical strategies to help people with their personal and business growth. With a passion for storytelling, smart risk taking, systems, and technology, she brings both vision and structure to every project she leads. She accepted the role at The Liquidity Journal not only to share powerful stories and practical knowledge, but to empower others to build, scale, and lead with intention.

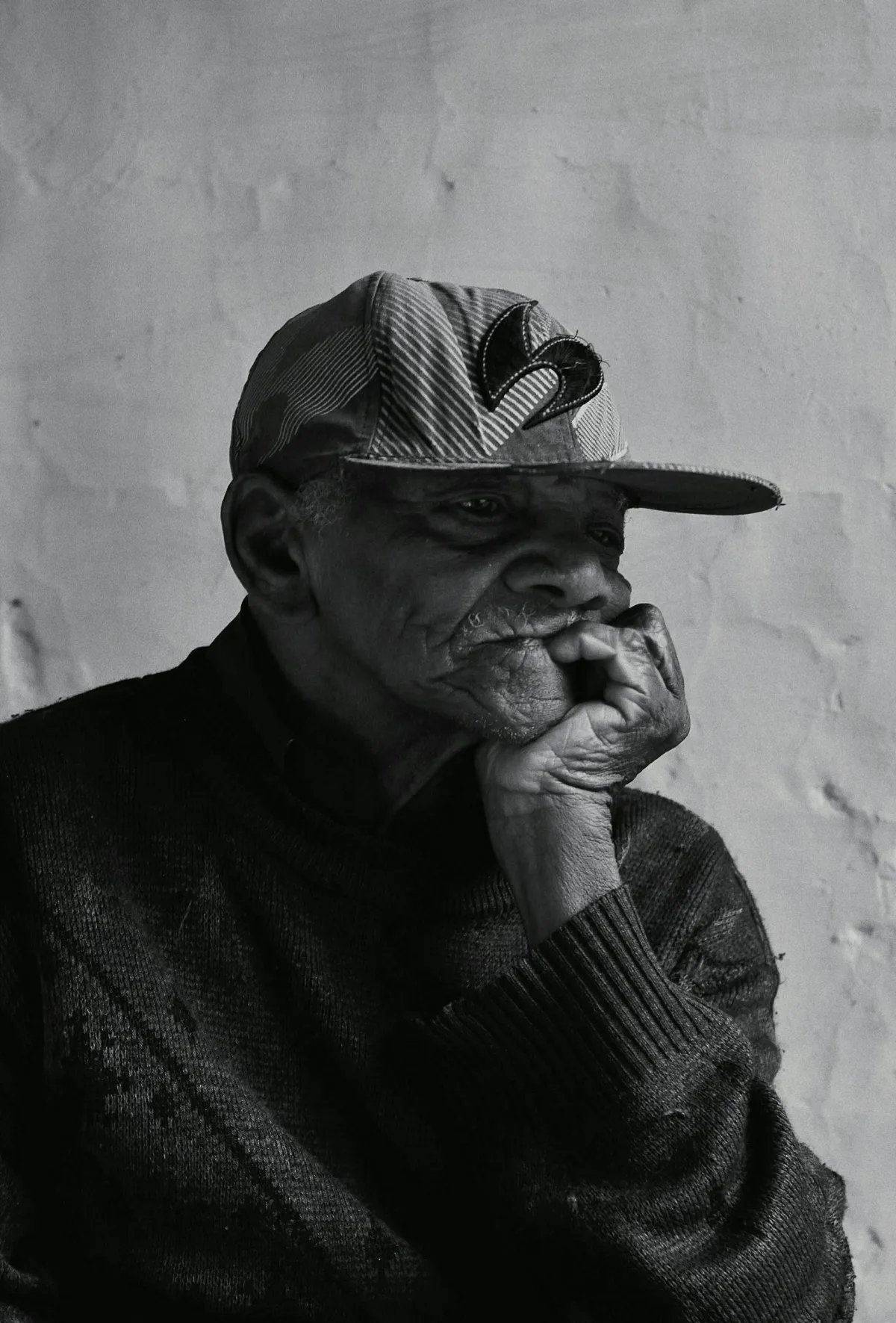

Randolph Love III

Publisher

Randolph Love III, is the Founder and President of, ShieldWolf Strongholds, a wealth protection company that specializes in providing Business Owners, Franchise Owners, and Retirees with high level Business Exit Planning, Retirement Income Planning, and Tax Free Cash Value Life Insurance education as a Certified IUL Master. He is a Partner and Consultant with The Franchise Consulting Company; one of the most renowned American owned franchise consulting companies in the world. He is the Author of the forthcoming Financial Literacy book, "The Miracle Money Vehicle: How To Make Money Make Babies;" which gives individuals and business owners a step by step guide on what they need to do to have the option to retire, or exit their current position in less than 5-10 years, with properly structured, and funded Trusts and Tax Strategies. Also, he is the host of, "The Entreprenudist Podcast: The Place To Hear Real Entrepreneurs and Business Owners BARE IT ALL;" ranked in the TOP 10% of podcasts for Business Owners and Entrepreneurs by ListenNotes.com.

Karin Hopkins

Contributor

Karin Grant Hopkins is an accomplished storyteller and a celebrated author. A former television news anchor, she developed strong production skills, which she has used as a civilian to make documentaries, training films, commercials and digital media content.

Karin retired from journalism to collaborate with her husband on entrepreneurial opportunities. After they established a PR company in New Orleans, she led the communications side of the business. The Essence Music Festival is among her success stories. The partnerships involved with the first Essence Music Festival were epic—Essence executives; Ed Lewis, Clarence Smith, Susan Taylor, Karen Thomas and Audrey Adams. George Wein, Quint Davis and Festival Productions Inc. led production services. Karin and her team created stellar PR campaigns. That alliance attracted 142,000 patrons to the first Essence Music Festival in 1995. Festival patrons pumped $75 million into the New Orleans economy transforming the normally sluggish summer season into a tourist bonanza. She was in charge of public relations for this event for seven consecutive years. During this time frame, the Essence Music Festival experienced tremendous growth in annual attendance and economic impact.

In 2004, Karin and Noah closed their business and relocated to Birmingham, Alabama where Karin worked for five years as Senior Public Information Officer for the Birmingham City Council. In 2009, she was asked by the President Pro Tempore of the Alabama Senate to join his team as Communications Director where her responsibilities included liaison to The White House. At every stage of her career, storytelling has been critical. It’s how she has connected with audiences to inform, educate and motivate them. In 2020, during a global pandemic, public outrage over social injustices and an unprecedented presidential election, storytelling was her escape from the craziness. The result is the book, The NEXUS Days, which she hopes is as enlightening for readers as it was therapeutic for her.

Her second book is RAW: Stripped Naked with Only the Truth for Cover, which was released in November 2024.

RAW tells it honest and uncut—a story of surviving the streets, hustling through chaos, and leveling up to success. From a troubled past to claiming power, it’s about owning your truth, no matter how messy and rising above it all.

Dr. Percell J. Sanders

Contributor

Dr. Percell J. Sanders a healthcare operations leader, Doctor of Chiropractic, and EMHA candidate with 8+ years of experience building high-performance clinical teams, streamlining multi-site operations, and delivering personalized, outcomes-based care. His leadership approach blends clinical excellence with strategic execution, whether driving patient access improvements, leading referral networks, or aligning front-line performance with organizational goals.

Dr. Sanders led multi-disciplinary teams across chiropractic, rehab, and primary care settings, and is skilled in EHR optimization, compliance oversight, patient-centered scheduling models, and PI workflows. He's currently pursuing his Executive Master of Health Administration (EMHA) to sharpen his capabilities in system-level leadership, finance, and transformation strategy.

He looks to contribute in roles where clinical integrity, operational precision, and people-centered leadership are valued, whether as a Clinic Manager, Regional Ops Leader, or Clinical Director in chiropractic, primary care, or multi-site outpatient systems.

Letter From The Editor

Welcome to the very first issue of The Liquidity Journal!

If you’re reading this, you’re likely someone with vision; A business owner, an executive, an investor, or someone aspiring for something greater. This journal was created for you. It’s for those who dare to set big, hairy, audacious goals, the action takers, and especially, for those of us who get shit done. It’s a platform to share stories, ideas, and strategies that fuel business and personal growth.

This theme, New Chapters, hits close to home for me. I recently moved to a new state and stepped away from my corporate job to build something that felt more aligned with my inner self. The Liquidity Journal is a piece of that.

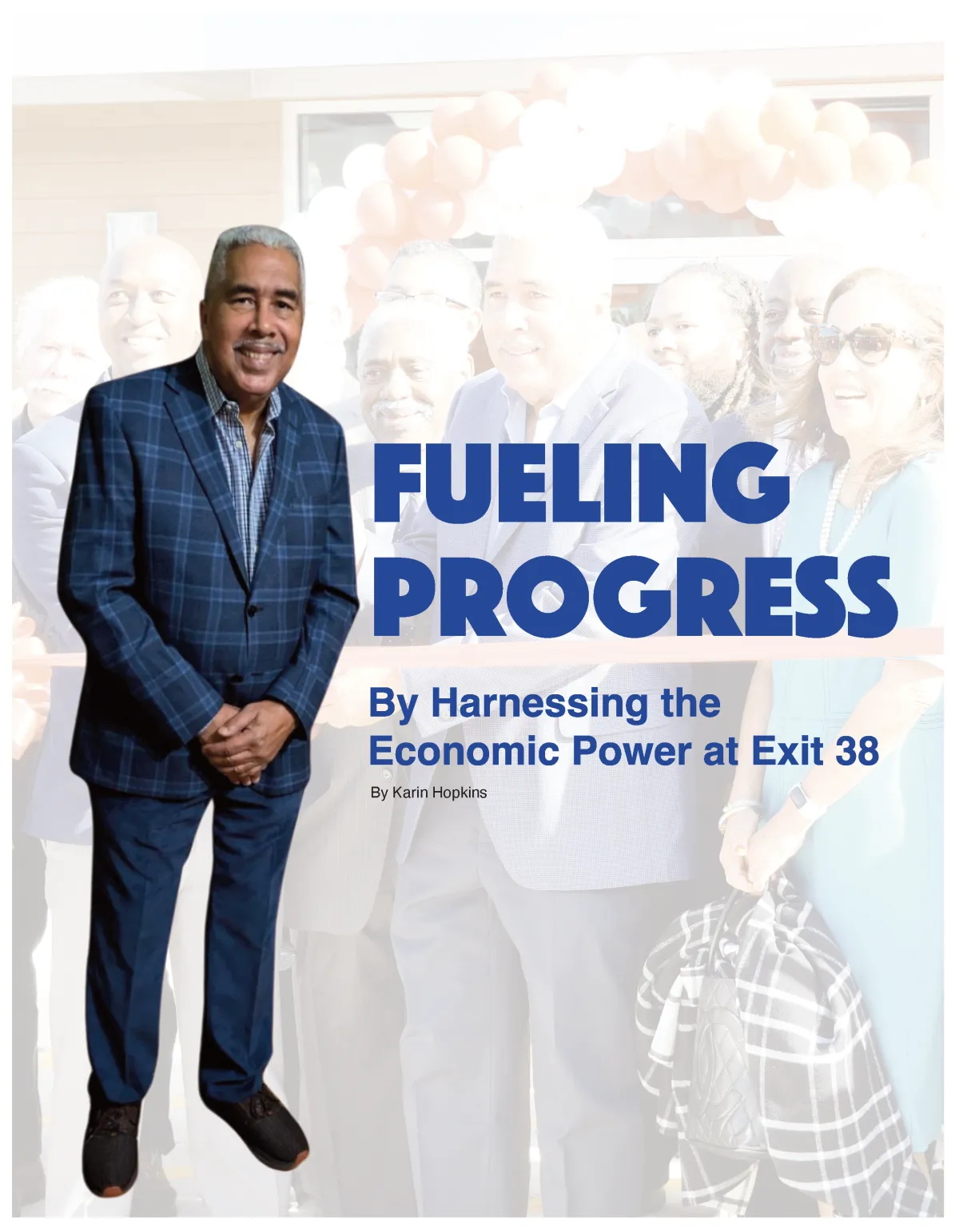

In this issue, we spotlight Fueling Progress, the story of the visionary who brought a new Pilot Truck Stop to an underdeveloped community in Tuskegee, Alabama. We dig into the essentials of rebuilding credit after identity theft, and we explore the F.O.R.D. method as a smarter way to build new partnerships through networking. And for those who are still waiting for the “perfect time” to start...don’t miss our piece on building the plane while flying it.

If there’s one thing I hope this journal inspires you to do, it’s this, take action. Don’t wait for perfect, perfect never shows up on time, but progress always pays off.

Thank you for joining me on this journey. Let’s build together.

Advertorial

Rebuilding Credit After Identity Theft: How to Start Fresh and Take Back Your Financial Power

Ciera Peters | The Liquidity Journal | Summer 2025

Photo by WildPexel | Getty Images

The journey to financial freedom is a marathon, not a sprint. When identity theft strikes, it can feel like you've been knocked back to mile one, with a damaged credit score, unfamiliar debt, and a shaken sense of security. Identity theft is no longer confined to careless password habits or misplaced wallets. It’s a sophisticated threat, often invisible until the damage is done. The good news? It’s possible to not only recover but to come back stronger.

Rebuilding credit after identity theft isn’t just about fixing numbers on a report, it’s about reclaiming control and turning a crisis into a turning point. That’s where trusted identity protection services like IdentityIQ come in, offering not only defense against future threats but the tools and support to start a new chapter with confidence.

The Emotional and Financial Toll of Identity Theft

Identity theft is more than a financial inconvenience, there's an emotional blow as well, a betrayal of trust in a system that’s supposed to protect you. According to the Federal Trade Commission (FTC), over 1 million identity theft reports were filed in 2023 alone, with many victims discovering fraudulent loans, credit cards, or even tax filings in their name. The path to recovery starts with one vital step: believing that your credit, and your life, can be rebuilt.

Restoration Through Precision

Once the immediate threat is neutralized, the work of rebuilding begins. The recovery process requires swift, deliberate action. This includes placing a fraud alert with the major credit bureaus (Experian, Equifax, TransUnion), freezing your credit reports, and filing an official identity theft report with the FTC. While procedural, these steps form the scaffolding of a larger restoration, the kind that’s best executed with tools designed for those who don’t leave details to chance.

The Quiet Power of Intelligent Monitoring

At this level of financial sophistication, proactive credit and identity monitoring is a necessity. Services like IdentityIQ are crafted for individuals who demand more from their protection. 24/7 monitoring of all three credit bureaus helps detect fraud before it spirals. Real time alerts on suspicious activity, and deep web surveillance for sensitive personal data. But it’s not just the technology that matters, it’s the discretion and responsiveness of the support behind it. IdentityIQ provides access to U.S. based identity restoration experts who manage the recovery process on your behalf. The inclusion of $1 million in identity theft insurance offers not both reimbursement and reassurance. It’s this level of attentiveness that elevates the service from utilitarian to essential.

A Statement of Control

In a world where privacy is luxury and confidence is currency, few things are as empowering as recovering from financial compromise with precision and grace. Identity theft may be a violation and recovery may feel overwhelming, but for the prepared, it’s not an end. It’s a turning point to take smarter steps, and to start fresh. Rebuilding your credit isn’t about getting back to where you were; t’s about moving forward, more informed, more protected, and more in control than ever before. Whether you're rebuilding your credit score, applying for a new home, or just trying to feel secure again, IdentityIQ helps you move forward with clarity and confidence.

Get 3 bureau credit reporting and $1,000,000 in identity theft insurance with Identity IQ for immediate monitoring and coverage on their website.

ADVERTORIAL

Rethinking Retirement: Why Some Experts Say Indexed Universal Life Beats a 401(k)

Ciera Peters | The Liquidity Journal | Summer 2025

Photo Generated by Ciera Peters using Sora with prompt 'Create an image showing a life insurance policy boxing a 401k.'

Our current landscape of economic uncertainty, rising taxes, and market volatility, has affluent professionals and small business owners increasingly looking beyond traditional retirement vehicles. At the center of this shift is a growing comparison between Indexed Universal Life (IUL) insurance and the traditional 401(k) plan. Do traditional retirement vehicles like 401(k)s still make sense? IUL Godfather, Doug Andrew, has long argued “no,” and in a recent reaction video, wealth strategist Randolph Love Ill, ChFC®, CPCU®, CLU® doubled down on that sentiment; explaining why more sophisticated savers are turning to Indexed Universal Life Insurance (IUL) instead.

The 401(k) has long been the go to retirement vehicle, primarily due to its employer match and tax-deferred growth, but sentiments are changing. Andrew references an article in TIME Magazine that asserts 401(k)s are “a rotten repository for our retirement reserves”. That may sound provocative, but the logic behind it is difficult to ignore. While it’s widely used, the 401(k) was designed under assumptions that retirees would be in a lower tax bracket. Contributions are made with pre-tax dollars, reducing taxable income today, and growing tax-deferred until retirement withdrawals begin, but as we all know, most people are not in a lower tax bracket when they retire,” contrary to the traditional financial planning narrative. Love amplifies this by likening deferred taxation to rising rent in Atlanta: "It never goes down."

By deferring taxes, retirees often find themselves in higher brackets later, without the deductions they enjoyed during their working years (e.g., mortgage interest or retirement contributions). The result? More taxes, not less. Perhaps the most interesting analogy from the discussion is the notion of Uncle Sam as a “permanent tax lien holder” on your 401(k). According to Andrew and echoed by Love, a third of your savings, yes 33%, could be taxed away upon withdrawal. That employer match? It may only be enough to cover the tax burden. Andrew calls this a false sense of security: “What a great partnership! Until you realize the government gets a third of every dime.”

Another key disadvantage lies in Required Minimum Distributions (RMDs). At age 73, retirees must start withdrawing from their 401(k)s whether they need the money or not or face a 50% penalty. This forced liquidation can disrupt tax planning, impact Medicare eligibility, and ruin strategies designed for wealth transfer.

What about Roth 401(k)s? Andrew concedes that Roth 401(k)s are better than traditional ones, but still stops short of calling them ideal. His “Laser Fund” concept is essentially a well designed IUL that takes top honors for tax efficiency, liquidity, and legacy planning. Love agrees: “A Roth is better. But is it best? I don’t know. IULs make a strong case.”

Doug Andrew and Randolph Love suggest that a properly structured and max funded Indexed Universal Life policy offers a compelling alternative. It combines permanent life insurance with the ability to grow cash value based on the performance of a stock market index, like the S&P 500, without direct market participation. 401(k)s however, including Roths are directly tied to market performance and can suffer heavy losses during downturns. IULs, by contrast, offer a floor (typically 0%), meaning you don’t lose money even when the market does, have downside protection from the market. IULs grow cash value tax-deferred, allow tax-free withdrawals through policy loans (if structured properly), and no income taxes on death benefits for estate planning or legacy goals. With a 401(k), access to funds is restricted until retirement age, unless you pay penalties or take loans. IULs offer more flexibility, allowing access to accumulated cash value at any time, for any reason, without triggering taxes or penalties. In Love’s words: “Don’t think about what it is, think about what it does. It’s not just life insurance. It’s a retirement freedom tool.”

For many, the best path forward may not be a binary choice but a hybrid strategy, contributing enough to a 401(k) to earn the match, then channeling additional savings into IULs for tax-free growth and liquidity. As both experts emphasize, strategic thinking, not conventional wisdom, is what separates retirement success from regret."

"Are you planning your retirement...or Uncle Sam’s?" Andrew asks. It’s a question every investor must consider.

For more information on Indexed Universal Life Insurance, schedule an appointment with Randolph Love III.

Refined Comfort with a Hint of Rebellion: Breakfast at Cask & Kitchen, Dallas

Ciera Peters | The Liquidity Journal | Summer 2025

Logo at the entrance | Photo from Cask & Kitchen Dallas, TX; Hostess Desk | Photo by Ciera Peters; Hand Garnishing Eggs | Photo from Cask & Kitchen Dallas, TX; Dining Area | Photo by Ciera Peters; Fried Pork Chops with Eggs and Potatoes | Photo from Cask & Kitchen Dallas, TX

Tucked discreetly inside the Hilton Garden Inn in Downtown Dallas, Cask & Kitchen offers a breakfast experience that blends upscale ambiance without ever reaching for pretense.

The space strikes an elegant balance: cozy, but kind of posh. The moment you step inside, you're greeted with the kind of understated luxury that’s more felt than flaunted. Clean lines and neutral tones give the dining area a calm sophistication, while an upstairs lounge adds a touch of intrigue. With its low lighting and subtle speakeasy energy, it feels like a space made for hushed conversations over craft spirits, if not at 9AM, then certainly by dusk. One quirk, the absence of a restroom inside the restaurant. Guests must slip into the hotel lobby to find it. Still, the facilities are impeccably clean and brightly lit, although it was early hours, we feel it’s a reflection of the hotel’s overall attention to detail. The main dining area is thoughtfully arranged, though some of the two top tables lean toward intimate...borderline snug for those looking for elbow room. Fortunately, larger tables offer more breathing space, with plush seating that invites you to linger.

Breakfast here is a lesson in execution over extravagance. The build-your-own omelet was a standout: eggs whipped to a cloud like fluff, seasoned just enough to let the ingredients speak. The flavors were evenly layered, so every forkful had a balanced bite. On the side, the house potatoes deserve praise, sliced thick enough to deliver a satisfying crunch on the exterior while maintaining just the right amount of soft, warm center. It’s a texture play that many establishments aim for, but few deliver with such ease. Guest reviews also highlight the Chicken and Waffles and I lament not going back later for a cocktail as I read nothing but good things about their Old Fashioned.

Service, too, is quietly confident. The staff welcomed us with a warmth that felt genuine, never forced. Attentive without hovering, each team member checked in just enough to ensure the meal unfolded seamlessly.

Whether you're staying at the Hilton or simply seeking a refined yet approachable start to your day, Cask & Kitchen in Downtown Dallas deserves a seat at your table.

Coastal Living: A $2.5 Million Dollar Oceanfront Sanctuary in South Ponte Vedra Beach

Ciera Peters | The Liquidity Journal | Summer 2025

3083 S Ponte Vedra Blvd 32082 | NEFMLS

Rear Elevation 32082 | NEFMLS

Every great story begins with a setting and ours opens where the ocean meets the sky.

Welcome to 3083 S. Ponte Vedra Boulevard, in this premier installment of The Liquidity Journal, we begin where many dream of starting over: the tranquil shores of South Ponte Vedra Beach, Florida.

It is here, just north of the newly minted South Ponte Vedra Ocean Club and moments from the charm of downtown St. Augustine, where The Liquidity Journal Publisher, Randolph Love III and I arrived for the open house, hoping our camera and curiosity would be welcomed.

Completed in 2019, this four-bedroom, three-bathroom oceanfront home offers a front-row seat to the Atlantic and a modest, yet elevated lifestyle. As we step inside, we are greeted, not only by Listing Agent Kim Romano, but also by the panoramic ocean views that immediately steal the show. Nearly every room faces the ocean, blurring the line between inside and out. The upper level is an open concept design, where the kitchen, dining, and living areas flow without interruption with a generous oceanfront deck. Whether you're hosting a brunch at sunrise or dining under a canopy of stars, the setting will never cease to amaze.

Living / Dining Room | NEFMLS

Kitchen | NEFMLS

The primary suite is thoughtfully positioned to capture the sunrise, it features a spa-inspired bath, walk-in closet, and sliding glass doors that open to the sea breeze. There's also an additional bedroom and full bath on this level ensuring that guests or family are equally pampered.

Primary Bedroom | NEFMLS

Primary Bathroom | NEFMLS

Downstairs, there are two guest suites and a flexible lounge area, open directly onto a shaded patio. Beyond lies a paver terrace and private hot tub. An idyllic setting for evening cocktails or moonlit conversation.

Lower Patio | NEFMLS

Upper Patio | NEFMLS

Engineered for coastal longevity, the home sits atop twenty deep pilings with a steel-reinforced slab and hurricane-secured steel rods throughout. A new sea wall and full-house generator speak not only to comfort but also to peace of mind. Thoughtful amenities such as a two-car garage, generous paver driveway, and ample guest parking complete the offering.

For just around $2.5 million dollars, this is not merely a beach house. It is an address for those who crave the sound of waves and the rhythm of coastal living.

We arrived hoping to film a house tour. Kim was understandably apprehensive of the camera, but we came with good intentions (and free t-shirts) and left having made a friend. A lot of people tend to misunderstand the statement that it’s more blessed to give than to receive. It’s not that you should just give, give, give continuously, and just be happy; You give knowing that the universe will give it back. “The thing about it,” Love says, “the more you give, the more you get back.”

For more information contact:

Kim Romano 904-813-6923

Berkshire Hathaway Homeservices

Florida Network Realty

904-285-1800

MLS#: 2086608

Watch The Full Tour:

PAID ADVERTISEMENT

From the Kitchen Table to the C-Suite: How Cameron Bishop Helps Business Owners Sell Smart

Randolph Love III | The Liquidity Journal | Summer 2025

Photo Cameron Bishop

10,000 baby boomers turn 65 every day and most have no succession plan for their businesses. Cameron Bishop is proving that an exit doesn't have to mean surrender. It can mean strategy.

From scaling Intertec Publishing, a modest $7 million firm at the time, into a $400 million industry titan, to co-founding Ascend Media, building it from a kitchen-table startup to a $120 million powerhouse backed by J.P. Morgan Chase. Now, he’s guiding others through their final and often most misunderstood chapter: the exit.

In a revealing conversation on The Entreprenudist Podcast: The Place To Hear Real Entrepreneurs and Business Owners Bare It All, Bishop shares hard truths and strategic insights for entrepreneurs looking to unlock the true value of their businesses.

“Most owners spend 95% of their time working in the business, not on it,” Bishop said. “They’re building income, but not value. There’s a difference.”

Now serving as a Managing Director at Raincatcher, a Denver-based investment banking firm focused on lower middle-market business owners, Bishop works primarily with companies earning $1M to $10M in EBITDA. This niche, often too complex for traditional business brokers and too small for bulge-bracket banks, is exactly where Bishop’s experience shines.

Why Most Businesses Don’t Sell

In what he candidly calls “Dr. Phil work,” Bishop coaches business owners not just through the financials, but also the psychological journey of letting go.

“About 70–80% of businesses that try to sell... don’t,” he said. “And it’s not because they’re bad businesses, it’s because they didn’t plan properly. They waited too long, or they never professionalized their books.”

Among the top deal-killers Bishop identifies:

Poor accounting practices: “Cash basis accounting won’t cut it. Buyers need GAAP-compliant, accrual-based financials.”

Owner dependency: “If your business can’t function when you go on vacation, it’s not sellable.”

Lack of succession planning: “Many owners assume their kids want the business. Most haven’t even asked.”

His team at Raincatcher steps in to correct the course, turning chaos into clarity. They don’t just match sellers with buyers, they prep the business for a successful transaction, from reformatting financials to structuring seller notes and earn-outs.

Why the Time to Exit Is Now

Post-COVID, Bishop has noticed a shift. Before the pandemic, most business owners wanted to exit to travel or enjoy retirement. Today, many are just exhausted.

“They’re tired,” he said. “Supply chain disruptions, hiring headaches, inflation; these things crushed their optimism. They’re ready to move on but don’t know how.”

That's where Raincatcher’s hands-on, full-cycle approach comes in. Unlike some firms that disappear after securing a buyer, Bishop's team remains embedded through closing, often acting as a sanity-saving liaison between owners, lawyers, lenders, and tax specialists.

“We bring Wall Street sophistication downstream,” Bishop noted. “We hold your hand from engagement to wire transfer.”

What Sets Raincatcher Apart

The difference, Bishop explains, is service.

Raincatcher doesn’t just broker deals, they shape outcomes. Their team prepares bespoke marketing materials, organizes competitive auctions to drive value, and walks clients through every stage, translating legalese and financial jargon into business-owner language.

And unlike traditional firms that may prioritize volume, Raincatcher specializes in lower middle market companies, a space Bishop knows intimately after decades navigating the private equity world.

What Sets Raincatcher Apart

For Bishop, the best exits are not reactive, they’re engineered. His parting advice to business owners?

“Assume you’ll sell someday, even if you think you won’t. That means professionalizing early. Structure wisely. And most of all… get help.”

Because in business, as in life, doing it alone doesn’t always pay.

If you're a business owner thinking about your future, don’t wait for the stress to force your hand. Visit Raincatcher.com/contact and connect with Cameron Bishop today.

About Cameron Bishop

Cameron Bishop is a seasoned executive, investment banker, and serial entrepreneur. He scaled Intertec Publishing from $7M to $400M, co-founded Ascend Media, and has led exit planning strategies for companies ranging from $2M to $100M. Currently a Managing Director at Raincatcher, Bishop brings decades of M&A experience, strategic insight, and practical compassion to every client he serves.

Why the World’s Top Entrepreneurs Are Building Their Planes While Flying Them

Randolph Love III | The Liquidity Journal | Summer 2025

Photo Generated by Ciera Peters using Sora with prompt 'Create an image that depicts building a plane while flying it.'

There’s a phrase that’s gained quiet traction in entrepreneurship. It’s in boardrooms, green rooms, and backchannel masterminds:

“Everybody’s building their plane while flying it.”

At first glance, it may sound reckless, the kind of metaphor better suited to daredevils than executives. But lean in a little closer, and you’ll see it’s not a warning. It’s a principle of progress.

The most successful founders, creators, and investors aren’t waiting for perfect conditions. They launch with a strong idea, an urgent mission, and a willingness to evolve midair.

The myth of perfect timing

Conventional wisdom says: plan first, then execute. But the pace of innovation has rewritten that model. Today, waiting too long for the perfect plan is often a greater risk than moving with an imperfect one. Jeff Bezos didn’t wait until Amazon was fully optimized before launching it out of his garage. Elon Musk didn’t perfect the blueprint before sending rockets skyward. Even in private wealth circles and elite professional networks, the new edge isn’t polish, it’s Velocity.

The real art is adapting while in motion. It’s not just startup culture. It’s how legacy firms innovate without losing relevance. It’s how family offices adapt to emerging asset classes and how cultural tastemakers shift from idea to influence before the rest of the world catches on.

Progress over polish

The phrase “building the plane while flying it” reflects a mindset of creative resilience: Executing under uncertainty, embracing iteration, learning in motion. This approach doesn’t negate the need for discipline or strategy...quite the opposite. It demands more. More awareness. More course correction. More humility in the face of new data. It’s the antithesis of paralysis by analysis.

Elevating your altitude

In high level circles, the ones who ascend are rarely the ones with the most detailed plan. They’re the ones who take off and refine along the way, while surrounding themselves with advisors who help them do both.

PAID ADVERTISEMENT

Why Every Growth-Minded Business Needs a Multidisciplinary Advisor Like Christopher Papin

Randolph Love III | The Liquidity Journal | Summer 2025

Photo Christopher Papin

Attorney. CPA. Insurance Producer. Chris Papin brings clarity, strategy, and structure to business owners aiming to scale without surprises.

When it comes to business strategy, few advisors match the multidimensional prowess of Christopher Papin. Based in Edmond, Oklahoma, Papin stands at the intersection of law, finance, and insurance; a rare trifecta that gives him the edge to guide small business owners through the often murky waters of sustainable growth, legal compliance, and tax planning.

In a recent one-on-one interview on The Entreprenudist Podcast: The Place to Hear Real Entrepreneurs and Business Owners Bare It All, host Randolph Love III peeled back the curtain on Papin’s unique approach to advising. What emerged was a compelling portrait of a forward-thinking strategist who helps business owners go from reactive to proactive, without losing sight of the everyday fires they’re managing.

The Translator You Didn’t Know You Needed

With a JD from Oklahoma City University School of Law and a CPA license since 2007, Papin doesn’t just crunch numbers or review contracts, he interprets them, contextualizes them, and bridges the gap between disciplines that most small business owners struggle to unify.

“Legal, financial, and insurance terms are like foreign languages to many entrepreneurs,” Papin said. “It’s my job to translate those into plain English and show clients how they work together, not in isolation.”

That clarity has earned him accolades across industries. From being honored as a Trailblazer by the Oklahoma Society of CPAs to landing a spot in OKC BIZ’s Forty Under 40, Papin is more than a practitioner, he’s a thought leader.

Why Most Business Owners Are Planning Backwards

Papin and Love agreed: too many entrepreneurs confuse motion with strategy. “They build their plans backwards, reacting to problems rather than forecasting and insulating against them,” Papin noted.

His approach is to "future-proof" operations by laying down assumptions, stress-testing them, and then adjusting as life inevitably happens. Whether it’s a lease renewal, a tax surprise, or a sudden expansion opportunity, his clients already have the infrastructure, or the on-call advisor, to adapt swiftly.

Papin likens his method to preparing for a seven-game playoff series, not just game one. “If you go all-in on one move without thinking three or four steps ahead, you may win a moment but lose the match,” he said.

The Hidden Cost of Solo Expertise

One of the most enlightening takeaways from the podcast was Papin’s explanation of why siloed advisors often become liabilities.

“When attorneys plan without input from CPAs, or CPAs ignore legal risk, the client suffers,” he said. “Multidisciplinary planning under one roof doesn’t just streamline, it prevents misfires caused by the ‘game of telephone’ that happens when multiple firms are guessing each other’s intent.”

It’s a powerful reminder that business is not just about making money, but keeping it, protecting it, and ensuring it works long-term.

The Sandwich Analogy That Says It All

Papin’s ability to distill complex ideas into relatable frameworks is another asset. Take his “sandwich” analogy: compliance (tax filings, entity structure, legal basics) is the bread; planning is the meat, cheese, and fixings.

“Everyone gets the same bread, but what’s in the middle, that’s where differentiation and strategy live,” he said.

Applied Knowledge, Not Just Advice

The most successful business owners Papin works with are those willing to admit what they don’t know and seek clarity before calamity. As he and Love explored, the ability to say “I don’t know” isn’t weakness, it’s wisdom.

In an age where YouTube gurus promise zero taxes and infinite upside, Papin offers a grounded alternative: strategic pacing, thoughtful risk, and applied knowledge.

“It’s not about perfection,” he said. “It’s about iteration, direction, and having the right board member beside you, even if that board member also happens to be your CPA, your attorney, and your insurance advisor.”

If you're a business owner ready to stop reacting and start planning proactively with integrated legal, financial, and insurance support, visit papincpa.com to learn more about how they support growth-minded business or connect with Christopher on LinkedIn.

About Christopher Papin

Chris Papin is a multi-talented professional with a unique blend of expertise in law, accounting, and insurance. Based in Edmond, Oklahoma, Chris is a licensed attorney, Certified Public Accountant, and licensed life, accident, and health insurance producer. With a Bachelor's and Master's degree in accounting from the University of Oklahoma, Chris earned his CPA in 2007 and a Juris Doctor in 2008 from Oklahoma City University School of Law. He is admitted to practice before the United States Tax Court.

Recognized for his leadership and innovation, Chris was selected for the Oklahoma Bar Association Leadership Academy, honored as a Trailblazer by the Oklahoma Society of CPAs, and named to OKC BIZ's Forty Under 40. His ability to bridge legal and financial disciplines allows him to guide clients through business challenges with clarity and strategic insight.

Chris focuses on advisory services and forward-looking planning for business owners, helping them make confident decisions that fuel sustainable growth. A sought-after speaker and thought partner, he delivers practical insights grounded in decades of experience. Outside of work, Chris is also a youth soccer coach, having mentored players who went on to collegiate, professional, and international careers.

Unlocking Meaningful Conversations: How the F.O.R.D. Method Can Elevate Your Networking Game

Ciera Peters | The Liquidity Journal | Summer 2025

Photo by bluecinema from Getty Images Signature

When we’re all hyper connected and buried in endless LinkedIn requests, it’s easy to forget that effective networking isn't about collecting business cards or followers, it's about forming genuine connections and building new relationships. Whether you're navigating a crowded conference or joining a virtual meetup, one simple technique can help you build rapport quickly and authentically: the F.O.R.D. method.

F.O.R.D. stands for Family, Occupation, Recreation, and Dreams. Four categories of conversation that unlock meaningful dialogue and foster trust. Used by top sales professionals, business leaders, and seasoned networkers, this framework is a game changer for anyone looking to build stronger, more memorable relationships.

The brilliance of the F.O.R.D. technique lies in its simplicity and human centered approach. By focusing on universal topics that most people care about, you avoid small talk and create space for conversations that feel authentic rather than transactional. Let’s break down each component:

F – Family

Asking about someone's family invites personal storytelling and often reveals their values and priorities. Questions like “Do you have any family in the area?” or “How do you balance work and family?” can quickly build emotional connection.

O – Occupation

While “What do you do?” is a classic icebreaker, going deeper, such as “What got you into that field?” or “What’s something exciting happening at work right now?”, shows genuine interest and can uncover shared professional interests or goals.

R – Recreation

Recreation questions tap into passions and hobbies, which are key to forming memorable connections. Try, “What do you like to do outside of work?” or “Have you picked up any new hobbies lately?” This is where people light up and where you’re most likely to find common ground.

D – Dreams

This is perhaps the most powerful category. Asking someone about their goals or aspirations, “What’s something you’d love to accomplish in the next few years?”, not only sparks a deeper conversation, but also positions you as someone invested in their growth.

F.O.R.D. isn’t a script, it’s a compass. Here’s how to apply it, start with curiosity. Begin conversations with open ended questions and active listening. Let the other person lead, and follow the thread of their answers.

Mirroring: This one is a powerful addition that publisher of The Liquidity Journal and founder of ShieldWolf Strongholds, Randolph Love, says is a powerful way to keep the conversation going and also helps you be a better listener. At first, this may sound disingenuous, but in reality, mirroring or repeating the last few words of a person’s thought, lets the person know that you are actually listening to them. They may say “I came here on a temporary work assignment, but I decided to stay”. You could ask “why” or you could repeat what they said in the form of a question like, “You decided to stay?”. This will prompt them to elaborate, keeping the conversation flowing without being a string of back to back questions.

Watch for transitions: Naturally, the current topic will wind down, providing the opportunity to pivot. This is when you use what Chris Voss calls, “Tactical Empathy,” by starting your next sentence with one of three alternatives: SEEMS LIKE…, LOOKS LIKE, SOUNDS LIKE…

Using the previous scenario, you might say, “Seems like you must really love this area if you decided to make it your permanent home after your work assignment ended.”

It’s not a question, but just an observation that you made based on the conversation you both are having, once again confirming to the other person that you’re actually listening to them, and not just waiting to speak.

If the other person responds with, “That’s right!”, “Exactly!”, or they keep right on talking about their work, then you know you’ve done it right.

You could then go to “What kind of work assignment?” (Occupation) or “How do you like to spend weekends here?” (Recreation) or “So, what’s the meaning of all of this? What does the top of the mountain look like to you?” (Dreams).

Don’t force it: The goal is connection, not interrogation. If the conversation drifts into areas beyond F.O.R.D., that’s okay. Let it evolve naturally. The F.O.R.D. method aligns perfectly with the principles of emotional intelligence. It encourages empathy, curiosity, and deep listening qualities that not only enhance relationships but also differentiate true leaders from surface level networkers. In a business climate that values authenticity and collaboration more than ever, being able to connect on a human level is a superpower. Whether you're an entrepreneur seeking investors, a job seeker exploring new paths, or simply looking to expand your circle, the F.O.R.D. method provides a timeless, effective way to turn conversations into connections, and connections into opportunities.

Great networking isn’t about talking. It’s about listening. F.O.R.D. gives you the blueprint to listen with purpose and engage with heart. Because at the end of the day, people don’t remember what you said they remember how you made them feel.

PAID ADVERTISEMENT

From Copywriter to Closer: How Skip Wilson Built a Marketing Empire by Putting People First

Randolph Love III | The Liquidity Journal | Summer 2025

Photo Skip Wilson

Skip Wilson stands out. Not just for his expertise in constantly changing algorithms and platforms that rise and fall with the tide of consumer attention, but for his humanity.

The founder and CEO of DRAFT Media Partners didn’t set out to conquer the marketing world. In fact, if you ask him, marketing found him.

At just 16 years old, Wilson began his creative journey chasing a high school crush into a copywriting role. That innocent pursuit snowballed into a two-decade-long career that would see him become a web developer, a CNN iReport collaborator, and eventually the Vice President of Digital Media at iHeartMedia. But even now, as the head of a multi-location agency with over 100 clients, Skip still views success through the lens of empathy, self-awareness, and service.

“I’ve bumbled and stumbled my way into a good life,” he says, candidly. “I never planned on a marketing career. I just kept solving problems until marketing became the answer.”

Today, DRAFT Media Partners is a boutique powerhouse recognized as “Most Intuitive Software Developer” in 2023 and “Best Marketing Software Developer” in 2024 by the Innovation in Business MarTech Awards. At the heart of DRAFT’s success is its proprietary software: Dynamic Response Advertising Forecast Technology. This platform helps clients predict advertising outcomes with uncommon accuracy. But technology alone isn’t what separates Wilson’s firm from the pack.

“We’re small, but experienced. We don’t run campaigns. We build systems,” Wilson explains. “Systems that generate leads, sales, and real growth.”

What truly makes Wilson’s approach different is his insistence on addressing the human objective behind every campaign. His strategy starts with three sticky notes: one for message, one for audience, and one for action. “If you can answer those three questions clearly, you’ve done the hard part,” he insists.

While many marketers focus on shiny objects and the latest hacks, Wilson’s advice is refreshingly grounded. He compares Google and Meta to blue-chip stocks: dependable, proven platforms that rarely fail when used properly. “They're hard to mess up,” he says. “But if you want a 10x return, you better have your operations tight.”

That last part is critical. Wilson doesn’t just generate leads. He holds his clients accountable for what happens after the click. “A lot of agencies stop at lead gen,” he says. “We’ll ask what happened with the 100 leads you got last month. If you didn’t follow up, we’re going to help you fix that too.”

That operational lens has turned Wilson into part strategist, part systems architect. From CRM integration to performance forecasting, he’s a marketing partner with one foot in creative execution and the other in business continuity. And he’s not afraid to tap into the less polished feedback loops like angry customers.

“Cranky customers are gold mines,” he says with a laugh. “They’ll tell you what your friends won’t. What went wrong, what they expected, what the competition did better. You just have to listen.”

As host of The Advertising Podcast and a bestselling author, Wilson continues to teach others how to simplify complexity. He’s an advocate for data, but not at the expense of intuition. For him, the best campaigns are born from empathy, tested with A/B frameworks, and optimized with courage.

So what’s next for a guy who’s already engineered a lean, award-winning agency?

Wilson doesn’t pretend to have all the answers. In fact, he’s wary of those who do. “I’m wrong every day,” he says. “But I’m always willing to fix it the second time around.”

He likens himself not to a hero at the top of a mountain, but a climber mid-reach, always stretching for the next solution, the next iteration, the next better version.

“If there’s still one more rock to grab, I’m not done climbing.”

If you’re a marketing professional or entrepreneur tired of chasing shiny objects and want a partner to help execute with clarity, visit www.draftadvertising.com or connect with Skip Wilson directly on LinkedIn. Let’s talk about building something that actually works.

About Skip Wilson

Skip Wilson is the founder and CEO of DRAFT Media Partners, an advertising execution company that helps over 100 clients across four locations streamline marketing operations and get real results. Skip’s journey began at 16 as a copywriter, chasing a crush and landing a creative career. He evolved into a web developer, worked with CNN’s iReport, and later helped build Clear Channel’s digital division before serving as VP of Digital Media at iHeartMedia for over a decade.

Skip is also a bestselling author and host of The Advertising Podcast. Under his leadership, DRAFT Media Partners was awarded “Most Intuitive Software Developer” in 2023 and “Best Marketing Software Developer” in 2024 at the Innovation in Business MarTech Awards. Despite 20+ years in the industry, Skip never planned on a marketing career—he simply kept solving problems until marketing found him. He brings an empathetic, people-first approach to advertising and believes that understanding the human objective behind every campaign is the real secret to success.

Legacy Is a Daily Practice, Not a Final Chapter

Ciera Peters | The Liquidity Journal | Summer 2025

“Legacy is not what’s left tomorrow when you’re gone. It’s what you leave behind every day, with every interaction.”

- Boston Consulting Group

Legacy is often misunderstood as a grand finale. Like something that’s suddenly created at the end of a career, a company sold for billions, or a name etched on a foundation. For intentional leaders, legacy isn’t a distant destination, but it's a process like everything else. It’s built by the daily decisions that are woven into every interaction, choice, and system they create. Your present actions, shape your future. What you prioritize, how you show up, who you invest in…every small action shapes the culture, values, and infrastructure others will inherit. Not later, but now.

The CEO of a small business who makes a habit of mentoring their leadership team each week, not just on tasks but on strategic thinking, is legacy in action. When that CEO steps away for vacation, the team doesn’t falter. They thrive, carrying forward her vision with clarity and confidence. According to a 2023 Gallup study, "Companies with engaged workforces seemed to have an advantage in regaining and growing earnings per share at a faster rate than their industry equivalents.” The people you lead are already experiencing your legacy from your current habits. Are they being empowered or micromanaged?

Empowering others to lead with clarity scales your impact. You could start by documenting processes so your team can operate autonomously, give junior leaders a seat at the table to hone their decision-making, or remove yourself as the bottleneck. When you empower others to lead with clarity, you’re not stepping back, you’re scaling your impact by preparing others to take the lead without starting from scratch.

A leader who spends time cross-training employees, standardizing operations, and fostering a culture of accountability will feel confident when it’s time for someone else to drive. The company will not only survive, it will grow, because those daily practices built a transferable framework. This is the essence of legacy, systems and people equipped to carry forward your vision.

There’s also a motivational edge this mindset carries. It frees you from waiting for the “perfect” moment to make a difference. Whether you’re launching a startup, scaling a corporation, or transitioning to retirement, your legacy is unfolding now. Every decision to listen, empower, or innovate is a brick in the foundation of what you’ll leave behind.

This approach is feasible for all. Aspiring entrepreneurs can start by fostering trust with their first hire. Executives can model transparency in boardroom discussions. Retirees and investors can mentor the next generation, sharing wisdom that shapes futures. Every interaction is a chance to leave a positive mark, and those marks compound over time. You just need to live and lead as if what you’re building deserves to outlive you.

Legacy is not what you leave tomorrow, it’s what you’re building today. It demands presence, intentionality, and a commitment to transferability. Ask yourself, are you empowering? Are your systems scalable? Are you investing in people who can carry your vision forward?

For those aiming to grow, lead, and innovate, this is your challenge. Live and lead as if what you are building deserves to outlive you. Start small, but start now. Every interaction is an opportunity to shape a legacy that endures, not one day, but every day.

Legacy is not a final chapter. It’s every sentence you write along the way.

What daily habit can you adopt to build your legacy today? How can you empower one person this week to carry your vision forward?

How Reverse Mortgages Empower Retirees to Build Lasting Impact

Randolph Love III | The Liquidity Journal | Summer 2025

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

Many affluent homeowners find themselves reflecting on what truly constitutes a meaningful legacy. For countless individuals, the family home stands as a cornerstone of their estate, a tangible symbol of hard work, stability, and generational wealth. Yet, as baby boomers enter their golden years, a common dilemma emerges: being "house rich but cash poor." This predicament prompts a pivotal question: Can one access the equity locked in their primary residence without sacrificing the ability to pass it on to heirs? The answer lies in reverse mortgages, a financial tool that not only provides liquidity but also aligns seamlessly with the themes of impact and legacy. Drawing from insights provided by LTCi Training, this article explores how reverse mortgages enable retirees to enhance their quality of life while preserving their home for future generations.

Many affluent homeowners find themselves reflecting on what truly constitutes a meaningful legacy. For countless individuals, the family home stands as a cornerstone of their estate, a tangible symbol of hard work, stability, and generational wealth. Yet, as baby boomers enter their golden years, a common dilemma emerges: being "house rich but cash poor." This predicament prompts a pivotal question: Can one access the equity locked in their primary residence without sacrificing the ability to pass it on to heirs? The answer lies in reverse mortgages, a financial tool that not only provides liquidity but also aligns seamlessly with the themes of impact and legacy. Drawing from insights provided by LTCi Training, this article explores how reverse mortgages enable retirees to enhance their quality of life while preserving their home for future generations.

The borrowing capacity hinges on several factors, such as the age of the youngest homeowner (all must be over 62), the home's appraised value, existing equity, and prevailing interest rates. For instance, a 65-year-old might access around 45 percent of their home's value after closing costs, while that figure rises to 55 percent at age 75 and 65 percent at age 85. This scalability makes reverse mortgages particularly appealing for those in luxury markets, where high-value properties in prime locations can unlock substantial capital. The Federal Housing Administration's Home Equity Conversion Mortgage (HECM) dominates the landscape, offering federally insured protections that ensure borrowers never owe more than the home's value upon repayment, even if property values dip. This non-recourse feature shifts risk to the lender, providing peace of mind for those prioritizing legacy preservation.

As the baby boomer generation swells the ranks of retirees, the reverse mortgage market is on the cusp of exponential growth. Many older Americans own their homes outright, having diligently paid off mortgages over decades. However, fixed incomes often strain against rising living costs, healthcare expenses, and the desire for an enriched lifestyle. Reverse mortgages address this by transforming illiquid assets into tax-free cash flows that do not impact Social Security eligibility or count as taxable income. Repayment is deferred until the homeowner passes away, sells the property, or vacates it for 12 months or more, allowing them to remain in their cherished residence indefinitely.

Critics sometimes view reverse mortgages through a lens of caution, associating them with potential erosion of family inheritance. Yet, this perception overlooks the tool's inherent safeguards. Homeowners retain full title, and upon their passing, heirs inherit the property with options to settle the loan balance using personal funds, refinancing, or selling the home and pocketing any excess proceeds. Innovative strategies further enhance legacy planning; for example, some families secure life insurance policies on the homeowner, earmarking the death benefit to repay the mortgage and retain the property intact. This approach ensures the home, often imbued with emotional and historical significance, can continue as a family anchor.

The versatility of reverse mortgage proceeds extends their impact far beyond mere liquidity. Funds are frequently directed toward home modifications for aging in place, such as installing ramps or energy-efficient upgrades, ensuring the residence remains a safe haven. Others allocate resources to supplemental retirement income or long-term care services. Notably, LTCi Training highlights a strategic edge: rather than depleting cash on direct care costs, borrowers can leverage proceeds to purchase long-term care insurance. Options include using a line of credit's annual interest growth to cover premiums, investing a lump sum in a single-pay policy, or funding annuities that guarantee lifelong coverage. This multiplier effect amplifies the funds' utility, fostering financial resilience and allowing retirees to focus on creating lasting memories rather than fretting over unforeseen expenses.

Regulatory enhancements have bolstered the product's credibility and consumer protections. The Housing and Economic Recovery Act of 2008, effective October 1, 2008, introduced key reforms to the HECM program. Borrowing limits were elevated to $417,000 nationally (up to $729,750 in high-cost areas), with subsequent adjustments bringing the 2016 cap to $625,500 across all regions. Origination fees were capped at 2 percent on the first $200,000 borrowed and 1 percent thereafter, not exceeding $6,000, with provisions for inflation-linked increases. Critically, the act prohibits lenders from bundling reverse mortgages with other financial products like insurance or annuities, curbing potential conflicts of interest. While exceptions exist for institutions with robust safeguards and firewalls, these measures prioritize transparency and borrower autonomy.

In the context of impact and legacy, reverse mortgages transcend transactional finance; they empower retirees to live purposefully. By unlocking home equity, individuals can invest in philanthropic endeavors, support family ventures, or simply enjoy the luxuries they've earned, all while safeguarding their primary asset for heirs. This aligns with a broader ethos of strategic wealth management, where liquidity fuels both personal fulfillment and intergenerational transfer.

For those contemplating their next chapter, the time to act is now. Secure your retirement Life Strategy by scheduling an appointment with ShieldWolf Strongholds at www.shieldwolfstrong.com. Their experts stand ready to guide you through personalized retirement and estate planning, ensuring your legacy endures with profound impact.

Building What Outlives You: Creating a Legacy Business

Ciera Peters | The Liquidity Journal | Summer 2025

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

Every founder dreams of creating something that lasts; something that continues to grow, innovate, and thrive long after they’ve stepped away. Building a “legacy business” is about creating an organization resilient enough to survive leadership transitions without losing momentum or culture. Icons like Coca - Cola, Ford Motor Company, Disney, and Delta Airlines exemplify this principle. They didn’t just build profitable companies, they built enduring institutions that outlive their founders.

The journey to a legacy business begins with a mindset shift. It’s not enough to be the best at what you do, you must also ensure the business is structured to succeed independently. This requires three critical pillars: documenting systems, delegating authority, and succession planning.

Documenting Systems

The first step in building longevity is creating repeatable, well-documented processes. Systems are the backbone of consistency and quality. Whether it’s operations, sales, marketing, or customer service, having clearly defined procedures allows your team to replicate success without constant oversight.

Consider Walmart. Sam Walton didn’t rely on being in every store personally. Instead, he built operational systems that allowed employees at every level to follow consistent processes, driving efficiency and scalability. The result: a business that could expand rapidly while maintaining standards.

Documenting systems isn’t only about manuals or checklists; it’s about capturing the essence of how your business functions, from decision-making to problem-solving. When systems are codified, you create institutional knowledge that survives personnel changes.

Delegating Authority

The next pillar is delegation. Many founders struggle to let go, believing that their presence is indispensable. Yet the reality is that no founder can or should do everything. Delegation is essential for longevity.

Legacy businesses empower leaders at every level to make decisions confidently within a structured framework.

Take Ford as an example. Henry Ford’s vision drove the company, but it was the leaders he trusted and systems he put in place that ensured Ford’s survival after his tenure. Delegating authority is not about relinquishing control, it’s about putting the right people in the right seats and entrusting your capable team members with clear responsibilities and accountability.

When authority is appropriately delegated, the business can operate efficiently without relying on a single individual. This not only ensures continuity but also nurtures the next generation of leaders who can carry the company forward.

Succession Planning

Perhaps the most critical element of a legacy business is succession planning. Who will take the reins if the founder steps down, retires, or moves on? Succession planning is a strategic blueprint for the future.

Leadership transitions are carefully planned and executed to preserve the company’s culture, values, and operational integrity. By identifying future leaders early and providing structured mentorship, they ensure the organization remains stable and thriving.

At ShieldWolf Strongholds, we help founders translate this principle into actionable strategies. Through custom life strategies for business valuation and exit planning, as well as retirement planning and estate planning. We provide a framework that protects the founder’s legacy while preparing the business for long-term success. Succession planning becomes not just an abstract concept, but a concrete plan to secure your vision for generations to come.

The Legacy Mindset

Building a business that outlives you requires intentionality. It means investing time in systems, nurturing leadership talent, and planning for the inevitable transitions every company faces. A legacy business is not built overnight. It is the result of disciplined, forward-thinking leadership.

For founders, will your business not only survive, but will it thrive without you. By embracing systems, delegation, and succession planning, you create a business that continues to grow, innovate, and inspire long after your tenure ends.

Start your journey toward a legacy business, visit ShieldWolfStrong.com to learn how a custom Life Strategy can help protect your wealth, secure your succession plan, and ensure your business thrives for generations.

SO YOU HAVE A

BULGING OR

HERNIATED DISC?

Dr. Percell Sanders | The Liquidity Journal | Summer 2025

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

Dr. Percell J. Sanders | Dr. Ayla Rose Yarbrough

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

WHAT YOU SHOULD KNOW IF YOU ARE DIAGNOSED WITH A BULGING OR HERNIATED DISC

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

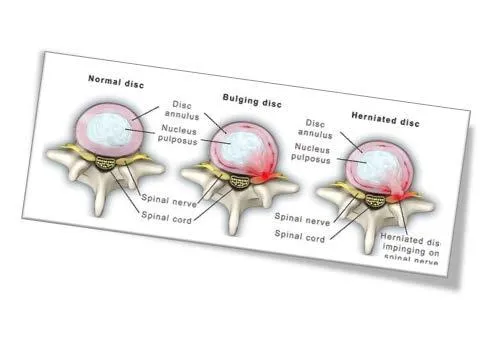

WHAT IS A BULGING OR HERNIATED DISC?

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

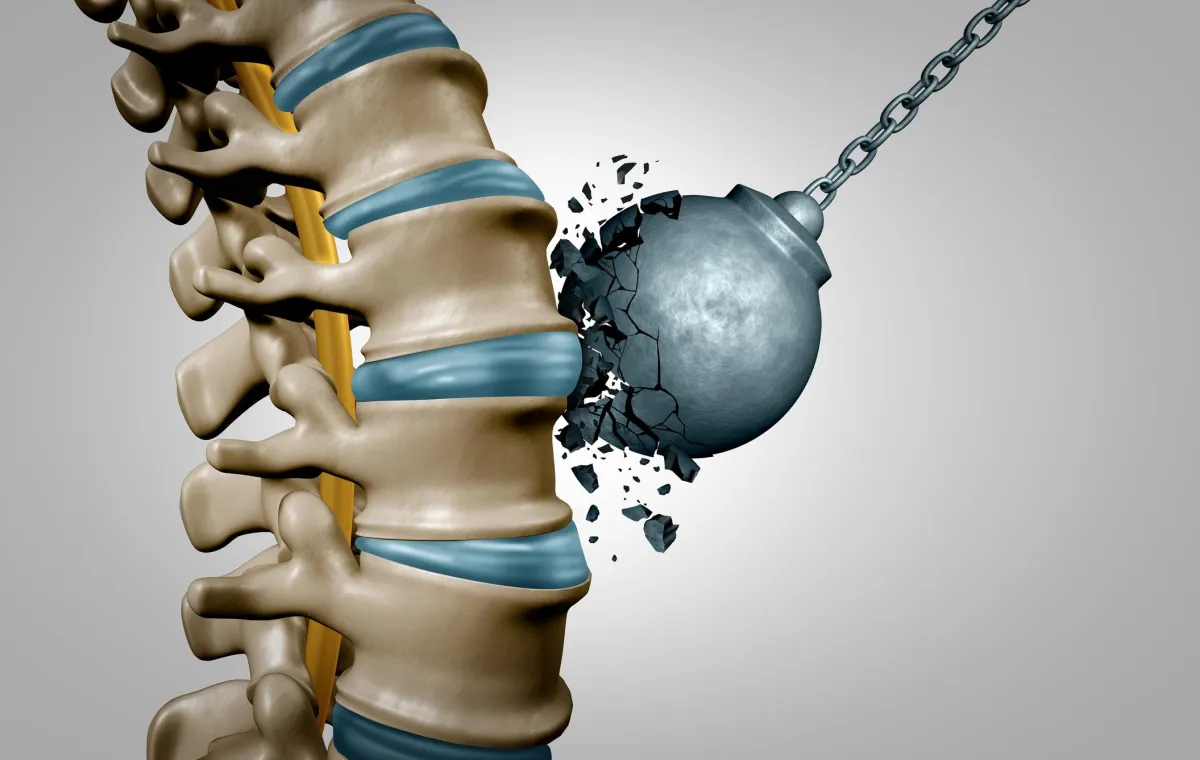

To better understand the issues of a disc, first we must understand what a disc is. The spine is made up of primarily 26 bones (vertebrae) stacked on top of one another. Between each of these bones lies an intervertebral disc, which acts as a “shock absorber” in the spinal column. With these discs we are afforded the ability to move the way we move our bodies daily; walking, lifting, bending over to pick up a baby, jumping up and down to shoot a basketball, the flexibility to tie our own shoes just to name a few. All these activities are made possible because we have the flexibility to perform them thanks to the discs in our spine.

Discs are made up of approximately 60-70%water. They are also one of the few structures in the body with limited to no blood supply. This makes it vitally important to always stay hydrated to assure the discs have the “nutrients” needed to thrive and survive. Remember, movement is important.

But what happens when someone is diagnosed with a bulging or herniated disc? What is it? Can it be cured? Will someone be in pain for the rest of their lives? How can someone acquire a bulging or herniated disc?

All of these are commonly asked questions, and we are here to answer them for you. First, what causes damage to a disc? The answer to this is very broad. Many factors can play into an injured or degenerative disc. Age, for one, can play a major factor. As we age, the jellylike substance (discs) begin to wear and tear, sort of like the tires on your car, the more you ride around on them the more worn out they become. Another factor that plays into disc wear and tear is trauma. Car accidents, slip and falls, jumping from high places, just to name a few can cause major trauma to our discs leaving us to deal with the consequences later in life if we do not seek the proper treatment for them in time.

So, is it a herniated disc or just the everyday back pain? The answer to this question lies in where the pain may be located. Although herniated discs may occur in any part of the spine, they commonly appear in the low back

(lumbar spine) and can also appear more often in the neck region (cervical spine). The pain may spread from the low back area to the buttocks region, the thigh area, the calves, and/or even the feet and toes. In the neck area, you could feel the pain spread to the arms, the hands, or even the fingers.

BULGING DISC

A bulging disc doesn't always affect the entire perimeter of a disc, but at least a quarter if not half of the disc's circumference is usually affected. Only the outer layer of tough cartilage is involved.

HERNIATED DISC

A herniated disc results when a tear in the tough outer layer of cartilage allows some of the softer inner cartilage to protrude out of the disc. Herniated discs are also called ruptured discs or slipped discs.

DISCS MADE SIMPLE

There are several symptoms that are commonly expected when diagnosed with a bulging/herniated disc. While the proceeding list contains several symptoms that can be experienced with a disc injury, not all are guaranteed to be a symptom for you. No one disc injury is created equally, so that means what one person may experience with a herniated disc, another person may have a completely different experience. Here’s a list of possible symptoms:

Tingling, aching, or burning sensations in the area

Pain with walking

Pain with prolong sitting and/or standing

Pain and numbness which is more commonly on one side of body

Unexplained muscle weakness

Pain that extends to arms & hands and/or legs & feet

Pain that worsens with certain movements

Paint that worsens at night

How are discs diagnosed?

Discs are mainly diagnosed, not only through physical and neurological examinations, but primarily by imaging. We find it of upmost importance to do an MRI (Magnetic Resonance Imaging) to determine the type and severity of disc damage there may be in the spine. MRI’s will allow the doctor to determine where and how severe the disc bulge/herniation is.

100% FACT

Overweight individuals can be at an increased risk for a slipped disc. Their discs must support additional weight which can become an ongoing issue for the low back later in life. Weak muscles and a sedentary lifestyle may contribute to the development of a slipped disc.

HOW CAN WE HELP YOU?

When suffering from a bulging/herniated disc it is imperative to seek treatment as soon as possible. If left untreated, a disc injury can lead to permanent nerve damage, and in rare cases, cause cauda equina symptoms which affect the bowel and bladder control. It can also lead to saddle anesthesia which causes a loss of sensation to the inner thighs, back of the legs and around the rectum.

We want to make sure you are as prepared as possible to deal with a problem such as a bulging and/or herniated disc. We will evaluate you by performing a physical and neurological exam to locate the source of your pain. This will include evaluating the function of your nerve and muscle strength, and if you feel pain when moving a certain way or touching a particular area.

We will come up with a treatment plan that is specific to you and your needs. While many may seek surgical intervention as a first option to treating pain and discomfort due to a disc bulge/herniation, it is our goal to address and treat your problem before you feel the need to consider any surgical options.

Addressing, not only your pain and discomfort, but the cause of the pain and discomfort is our top priority.

For more information, contact 904.822.4262 or [email protected].

No Green Bananas

Randolph Love III | The Liquidity Journal | Summer 2025

Image generated using the following prompt: Create a realistic magazine image of a couple in their 60s standing happily in front of a house, with the house as a focal point.

"When the lion is hungry, he eats. When the eagle has thirst, he drinks. Lest they act, both will perish. I hunger for success. I thirst for happiness and peace of mind. Lest I act, I will perish in a life of failure, misery, and sleepless nights. I will command, and I will obey mine own command. I WILL ACT NOW!"

-Og Mandino, "The Greatest Salesman in the World" (Audio Book)

I used to be an insurance producer. I did inbound property and casualty sales, over the phone, for one of the biggest insurance companies in the United States, State Farm (SF). Myself, and the other people in my position, were considered to be the face of SF; and first-line underwriters. First-line underwriters, because once we determined eligibility, and acceptability, and took the first payment of premium, the customer was immediately insured; and this was before the underwriting department had the opportunity to review the insurance application.

An insurance policy is a contract. In its simplest form, this contract only has two promises. The insured promises to pay the first premium payment, and the insurer promises to step in if a covered loss occurs. If a covered loss occurred immediately after first payment, the carrier is bound to perform.

One of the reasons we were considered to be the face of SF was because, other than an insurance claim, the only time most people ever talk to their insurance company is when they’re starting new insurance for the first time; or adding to, or replacing existing insurance. As a customer, however you’re greeted, and assisted during those few interactions, is how you’d typically gauge the quality of your insurance company.

Insurance is an intangible product. You can’t actually touch it. The only real measurable, and therefore tangible factors are how you’re treated during these encounters. Depending on how you’re treated, will determine if you’ll remain with that insurance company, or not. Regardless of price, in a lot of instances

For nearly a decade, I’ve worked for SF in some way, shape, or form. Be it as a customer service representative, inbound sales as a licensed insurance producer, or as an independent contractor.

I actually really liked doing inbound sales. Which is very different, and arguably much less difficult than cold calling a potential customer. When a prospect takes the time, out of their day, to voluntarily call a vendor, opposed to someone calling them out of the blue, the caller typically already knows they want to buy your product. As the inbound sales person, my job was to make the transaction as easy as possible for them; in exchange for their money.

I only worked 30 to 35 hours a week, with 5 to 6 weeks vacation every year. I was provided with health insurance, life insurance, disability insurance, and mobile cell phone service discounts; just to name a few of the many amenities, and fringe benefits that are typically bestowed upon the employees of a Fortune 500 company. Along with a $50,000 plus annual salary, to boot; once I considered my hourly salary, plus commission.

Oh, how I long for the carefree days of a W2, salaried employee. Well... not really.

... but I digress.

Though those employee benefits were great, in retrospect, what I truly miss about those days were the people that I worked with. Some of my best memories involve the people that I met while working on that job. I also miss the phone conversations with the literally thousands of customers I’ve assisted over the years, while working in that role. I was licensed to sell insurance from Florida, to New York. New York, to California. California, to Texas; and many of the other states in between. So as you can imagine, I’ve had the privilege of conversing with a multitude of personalities; from different social, economic, and political backgrounds.

“Young man, at my age there are two things I don’t do...

I don’t buy green bananas; and I don’t pay for my auto insurance, in advance.“

Of those many phone calls, there’ve only been a hand full of calls that have stuck out, and stood the test of time in my memory banks.

One was a call I received from an older insured. The names have been changed to protect the rights of the innocent, so let’s call him Mr. McIntosh. Mr. McIntosh was eighty plus years old, and still driving!

He knew exactly what he wanted when he called. He wanted to start auto insurance on his new car, and he wanted to make the first month’s payment for the policy, and pay month to month after that.

This is the moment that I decide to make a helpful suggestion to Mr. McIntosh. I inform him that he’d save money, in service charges, if he’d pay for 6 months premiums, up front.

He stopped me in my tracks. He said, “Young man, at my age there are two things I don’t do. I don’t buy green bananas; and I don’t pay for my auto insurance, in advance.“

What does this even mean? Well when a person makes a decision to buy green bananas, they understand that they can’t eat the bananas immediately; they have to wait for the bananas ripen. They assume that they have the luxury of time. By fighting against their need for the instant gratification of consuming the delicious, and healthy treat, they make the optimistic bet that they’ll be around to reap the rewards of their patience. Freshly ripen bananas taste AMAZING!

That same mindset could to applied to someone who pays for auto insurance in advance. They sacrifice the instant gratification of utilizing that extra money today, in hopes of having more money to utilize in the future, due to saved transaction fees.

Mr. McIntosh was very aware of himself. He was very aware of what he does, and does not do, regardless of how much money anyone might claim that he’s leaving on the table. The principles that he, undoubtedly, put in place for good reasons; through a lifetime of rigorous trial and error. He don’t buy green bananas and he don’t pay for auto insurance in advance. He was very aware he no longer had the luxury of time. If he ever even had it in the first place.

Do you have the luxury of time?

Subscribe To The Liquidity Journal

To get each new issue of The Liquidity Journal sent directly to your inbox, along with additional information and invites to local networking and learning events.

ABOUT ME

WEDDING PHOTOGRAPHER

RENNA MAISON

My photography journey began [mention how and when you started photography]. What started as a hobby soon turned into a deep-seated passion that led me to explore various genres, techniques, and styles. Over the years, I've had the privilege of working with diverse clients and subjects, each experience adding to my growth as a visual storyteller.

270+

PROJECTS

180

HAPPY CLIENTS

3,003

CUP OF TEA

12

AWARDS WIN

MY SERVICES

DESIGNED WITH CARE, FILLED WITH CREATIVE ELEMENTS.

Potrait photography

Capturing the essence of individuals and personalities through striking portraits that reveal unique stories in every frame.

Wedding photography

Documenting the most cherished moments of your special day with a blend of candid shots and timeless poses, preserving the love and joy for generations to come.

Event photography

Immortalizing the energy and emotions of events through dynamic photography, ensuring that every significant moment is beautifully preserved.

Product photography

Showcasing products in their best light, with attention to detail and creative compositions that bring out the essence and desirability of each item.

Professionals Team

John Doe

Jane Doe

John Doe

FAQS

What is your photography style?

My photography style is characterized by capturing genuine and candid moments. I believe in preserving the natural emotions and interactions of the subjects, whether it's a spontaneous laugh or a heartfelt glance. This approach ensures that the images evoke real feelings and tell authentic stories.

How do you handle different lighting conditions?

I am experienced in working with a variety of lighting situations, from bright outdoor settings to dimly lit indoor venues. I use a combination of professional equipment and techniques to adapt to each scenario, ensuring that I capture the best possible shots while maintaining the desired mood and ambiance.

What's the process for booking a photography session?

Booking a photography session is a straightforward process. Simply get in touch with me through the contact form on my website or give me a call. We'll discuss your photography needs, preferred date, location, and any specific ideas you have in mind. Once we finalize the details, I'll provide you with a quote. Upon agreement, a deposit will secure your booking, and we can start planning for your memorable photography experience.

TESTIMONIALS

"I can't express how thrilled we are with the photos [Your Name] captured during our wedding day. Every image reflects the joy, excitement, and love that filled the air. Their ability to blend into the background while capturing the most intimate moments amazed us. Our photo album is a treasure we'll cherish forever. Thank you for making our special day even more memorable!"

JANE DOE